PARIS, Feb. 7, 2018 /PRNewswire/ -- Sanofi (NYSE: SNY; EURONEXT: SAN)

|

Q4 2017 |

Change |

Change |

Change |

2017 |

Change |

Change |

Change | |

|

IFRS net sales reported |

€8,691m |

-2.0% |

+4.1% |

-1.6% |

€35,055m |

+3.6% |

+5.6% |

+0.5% |

|

IFRS net income reported |

€129m |

-83.7% |

- |

- |

€8,434m |

+79.1% |

- |

- |

|

IFRS EPS reported |

€0.10 |

-83.9% |

- |

- |

€6.71 |

+83.3% |

- |

- |

|

Business net income(1) |

€1,332m |

-17.1% |

-10.8% |

- |

€6,964m |

-4.7% |

-2.6% |

- |

|

Business EPS(1) |

€1.06 |

-15.2% |

-8.8% |

- |

€5.54 |

-2.5% |

-0.4% |

- |

|

Fourth-quarter and 2017 accounts reflect the acquisition of the former Boehringer Ingelheim Consumer Healthcare (CHC) business and the disposal of the Animal Health business (completed on January 1, 2017). In accordance with IFRS 5 (Non-Current Assets Held for Sale and Discontinued Operations), Animal Health results in 2016 and gain on disposal in 2017 are reported separately. Fourth-quarter and 2017 income statements also reflect the consolidation of European operations related to Sanofi vaccine portfolio, following the termination of the Sanofi Pasteur MSD joint venture (SPMSD JV) with Merck at the end of 2016. | ||||||||

Experience the interactive Multichannel News Release here: https://www.multivu.com/players/English/8268451-sanofi-2017-annual-results/

(1) In order to facilitate an understanding of operational performance, Sanofi comments on the business net income statement. Business net income is a non-GAAP financial measure (see Appendix 10 for definitions). The consolidated income statement for Q4 2017 and 2017 is provided in Appendix 3 and a reconciliation of IFRS net income reported to business net income is set forth in Appendix 4; (2) CS: constant structure: adjusted for BI CHC business, termination of SPMSD and others; (3) changes in net sales are expressed at constant exchange rates (CER) unless otherwise indicated (see Appendix 10); (4) based on current understanding of the US tax reform; (5) Subject to the completion of the acquisition; (6) 2017 business EPS was €5.54

Sanofi Chief Executive Officer, Olivier Brandicourt, commented:

"In 2017, we continued to execute on our strategic goals with the strong launch of Dupixent®, the positive pivotal data for cemiplimab and for dupilumab in asthma. At the same time, we managed the challenges in U.S. diabetes as well as the impact from sevelamer generics and Dengvaxia®. Recently, we announced a series of strategic steps - we are obtaining the global rights to fitusiran and plan to acquire Bioverativ and Ablynx - which will establish Sanofi as a new global leader in rare blood disorders. Additionally, these actions will further strengthen our pipeline and provide us with the powerful new Nanobody® technology platform. Overall, after a period of significant reshaping since 2015, we are positioned to drive growth in 2018."

Q4 2017 sales reflect strong Dupixent® launch offset by anticipated declines in U.S. diabetes and Renagel®

- Net sales were €8,691 million, down 2.0% on a reported basis and up 4.1%(3) at CER. At CER/CS(3), net sales were down 1.6%.

- Strong Sanofi Genzyme sales growth (up 16.8%) driven by contribution from new immunology franchise.

- Sanofi Pasteur sales increased 1.2% at CER/CS impacted by order phasing effects and Dengvaxia®.

- CHC sales grew 2.5% at CER/CS.

- Diabetes and Cardiovascular GBU sales down 19.1%.

- Emerging Markets sales increased 2.1% at CER/CS, driven by Pharmaceuticals which increased 4.0% at CER/CS.

Sanofi Genzyme, Sanofi Pasteur and Emerging Markets sales growth more than offset Diabetes sales decline in 2017

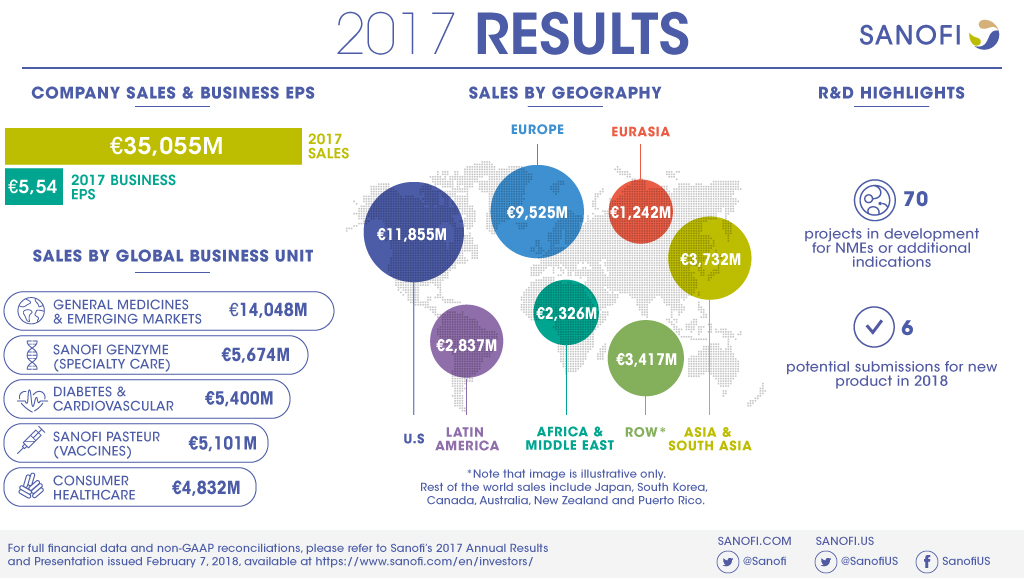

- Net sales in 2017 were €35,055 million, up 3.6% on a reported basis and 5.6%(2) at CER. Net sales were up 0.5% at CER/CS.

- Sanofi Genzyme grew 15.1% to €5,674 million while Sanofi Pasteur increased 8.3% (at CER/CS) to €5,101 million.

- Emerging Markets sales were up 6.0% at CER/CS supported by strong performance in China (up 15.1% at CER/CS).

- Diabetes and Cardiovascular GBU sales declined 14.3% to €5,400 million.

Sanofi meets its full-year 2017 business EPS guidance

- Q4 2017 business EPS(1) decreased 8.8% at CER to €1.06, including financial impact from Dengvaxia® (-€0.10).

- 2017 business EPS(1) of €5.54 (-0.4% at CER) and IFRS EPS of €6.71 (+83.3% on a reported basis).

- Net debt was €5,229 million at the end of 2017, a decrease from €8,206 million at the end of 2016.

- Board proposes dividend of €3.03, an increase of 2.4%.

- 2017 business net income (BNI) effective tax rate unaffected by the U.S. tax reform. In 2018, Sanofi expects the BNI effective tax rate to be around 22% primarily as a result of U.S. tax reform(4).

Sanofi progresses on its strategic priorities

- Sanofi to acquire Bioverativ(5) for $11.6 billion to expand in specialty care and strengthen its leadership in rare diseases.

- Sanofi to acquire Ablynx(5) for €3.9 billion to strengthen its R&D strategy with innovative Nanobody® technology platform.

- Agreement signed with Regeneron to accelerate and expand investments for the development of cemiplimab and dupilumab.

- FDA supplemental BLA submission for dupilumab in uncontrolled persistent asthma for adults and adolescents.

2018 financial outlook

- Sanofi expects 2018 business EPS(1) to grow between 2% and 5%(6) at CER, including the anticipated contribution from the recently announced acquisitions, barring unforeseen major adverse events. Applying the average December 2017 exchange rates, the currency impact on 2018 business EPS is estimated to be -3% to -4%.

R&D update

Sanofi presented its R&D strategy and innovative pipeline on December 13, 2017 which are summarized in the following press release: http://mediaroom.sanofi.com/sanofi-presents-rd-strategy-and-innovative-pipeline/

Regulatory update

Regulatory updates since December 13, 2017 include the following:

- In January, the Ministry of Health, Labor and Welfare (MHLW) in Japan granted marketing and manufacturing authorization for Dupixent® for the treatment of atopic dermatitis in adults not adequately controlled with existing therapies.

- In December, a marketing authorization application for patisiran (partnership with Alnylam), an investigational RNAi therapeutic targeting transthyretin for the treatment of adults with hereditary transthyretin-mediated amyloidosis, was submitted by Alnylam to the European Medicines Agency (EMA).

- In December a supplemental biologics license application for dupilumab (partnership with Regeneron) was submitted to the U.S. Food and Drug Administration (FDA) for uncontrolled, persistent asthma for patients aged 12 and over.

At the beginning of February 2018, the R&D pipeline contained 70 projects including 36 new molecular entities and novel vaccines in clinical development. 25 projects are in Phase 3 or have been submitted to the regulatory authorities for approval.

Portfolio update

Phase 3:

- At the end of 2017, the phase 3 program evaluating efpeglenatide (partnership with Hanmi), a weekly GLP-1 agonist, in type 2 diabetes was initiated.

- In December 2017, the FDA lifted the hold on clinical studies with fitusiran (an investigational RNAi therapeutic targeting antithrombin for the treatment of patients with hemophilia A and B; partnership with Alnylam), including the Phase 2 open-label extension (OLE) study and the ATLAS Phase 3 program.

Phase 1:

- In November 2017, Sanofi announced that Principia will grant Sanofi an exclusive, worldwide license to develop and commercialize SAR442168/PRN2246. This is a low dose covalent BTK inhibitor which crosses the blood brain barrier. Recently a Phase 1 clinical trial in healthy volunteers was initiated in multiple sclerosis.

Alliances/Collaboration

- In January, 2018, Sanofi and Regeneron announced that they will accelerate and expand investment for the clinical development of the PD-1 (programmed cell death protein 1) antibody cemiplimab in oncology and dupilumab in Type 2 allergic diseases.

- In January, 2018, Sanofi and Alnylam announced a strategic restructuring of their RNAi therapeutics alliance to streamline and optimize development and commercialization of certain products for the treatment of rare genetic diseases. Specifically:

- Sanofi will obtain global development and commercialization rights to fitusiran, an investigational RNAi therapeutic, currently in development for the treatment of people with hemophilia A and B.

- Alnylam will obtain global development and commercialization rights to its investigational RNAi therapeutics programs for the treatment of ATTR amyloidosis, including patisiran and ALN-TTRsc02.

- Sanofi recently signed a clinical collaboration agreement with Roche to explore the role of atezolizumab in combination with isatuximab in certain solid tumors, reflecting scientific evidence that checkpoint inhibition by CD38 may reverse resistance to PD-L1.

To access the full press release of the 2017 Q4 results, please click here.

2018 Guidance

Sanofi expects 2018 Business EPS to grow between 2% and 5% at CER, including the anticipated contribution from the recently announced acquisitions, barring unforeseen major adverse events. Applying the average December 2017 exchange rates, the currency impact on 2018 Business EPS is estimated to be -3% to -4%.

Forward-Looking Statements

This press release contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are statements that are not historical facts. These statements include projections and estimates and their underlying assumptions, statements regarding plans, objectives, intentions and expectations with respect to future financial results, events, operations, services, product development and potential, and statements regarding future performance. Forward-looking statements are generally identified by the words "expects", "anticipates", "believes", "intends", "estimates", "plans" and similar expressions. Although Sanofi's management believes that the expectations reflected in such forward-looking statements are reasonable, investors are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Sanofi, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include among other things, the uncertainties inherent in research and development, future clinical data and analysis, including post marketing, decisions by regulatory authorities, such as the FDA or the EMA, regarding whether and when to approve any drug, device or biological application that may be filed for any such product candidates as well as their decisions regarding labelling and other matters that could affect the availability or commercial potential of such product candidates, the absence of guarantee that the product candidates if approved will be commercially successful, the future approval and commercial success of therapeutic alternatives, Sanofi's ability to benefit from external growth opportunities, to complete related transactions and/or obtain regulatory clearances, risks associated with intellectual property and any related pending or future litigation and the ultimate outcome of such litigation, trends in exchange rates and prevailing interest rates, volatile economic conditions, the impact of cost containment initiatives and subsequent changes thereto, the average number of shares outstanding as well as those discussed or identified in the public filings with the SEC and the AMF made by Sanofi, including those listed under "Risk Factors" and "Cautionary Statement Regarding Forward-Looking Statements" in Sanofi's annual report on Form 20-F for the year ended December 31, 2016. Other than as required by applicable law, Sanofi does not undertake any obligation to update or revise any forward-looking information or statements.

Media Relations:

Ashleigh Koss

908-981-8745

Email: Ashleigh.koss@sanofi.com

Investor Relations:

George Grofik

+33 (0)1 53 77 45 45

Email: IR@sanofi.com

SOURCE Sanofi